9 Easy Facts About Mortgages Vancouver Shown

Table of ContentsThe 7-Second Trick For Home Equity Loans BcHome Equity Loans Vancouver Fundamentals ExplainedThe Ultimate Guide To Mortgages VancouverMore About Second Mortgage VancouverEverything about Mortgages Vancouver10 Simple Techniques For Second Mortgage Vancouver

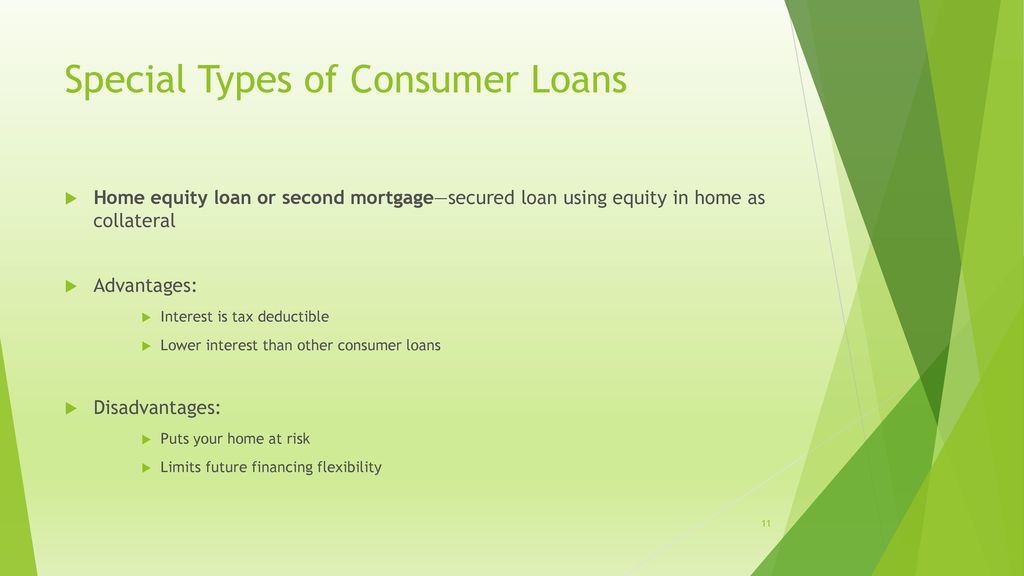

Still have inquiries? Right here are a few other concerns we have actually addressed:.In a home equity car loan, you can obtain a round figure of cash that you usually pay off in fixed installments over a term of five to three decades. Just how much you can borrow will rely on just how much of your residence you possess outright. Pros as well as disadvantages of a home equity financing Right here are some pros and also cons to think about prior to you begin completing lending documents.

It will not boost, also when the Federal Get elevates rate of interest. Making use of property as security commonly garners lower rate of interest rates compared to various other kinds of lendings. Because you're obtaining one round figure and have a fixed rates of interest, your repayments are predictable as well as will not vary over the life of the financing.

The Single Strategy To Use For Home Equity Loan Vancouver

If you choose to use your residence equity lending continues to boost your home, you may be able to subtract the interest from your gross income - Foreclosure Loans. Disadvantages Because a house equity loan's rate of interest will not change with the marketplace, unlike a residence equity line of credit rating (HELOC), the rate for a house equity financing is typically greater.

As with a lot of financings entailing actual estate, you'll most likely have to pay closing expenses. These prices can range from 2% to 5% of the financing quantity. If you still have a key home mortgage, you currently have 2 home mortgage settlements, which can reduce your non reusable earnings as well as make your month-to-month budget plan tighter. Second Mortgage Vancouver.

Several lending institutions have stringent house equity financing requirements, such as higher credit rating minimums as well as less flexibility for higher debt-to-income (DTI) proportions. Distinctions in between HELOCs as well as residence equity financings Several things are set in rock with a house equity car loan, such as your interest price. In a HELOC, nonetheless, several aspects can alter over time.

The smart Trick of Home Equity Loans Bc That Nobody is Discussing

3 choices to a residence equity finance Cash-out re-finance A cash-out refinance can be an effective financial device, offering you accessibility to the equity in your residence without creating a bank loan settlement. When you refinance right into a cash-out finance, you obtain greater than you need to mortgage your house and also pocket the difference in money.

If you expand your loan term, you might pay a lot more in rate of interest over the life of the funding. HELOCs have a set draw period, such as 10 years.

Loans Vancouver Can Be Fun For Everyone

Due to the fact that personal financings aren't safeguarded they just depend on your credit history their rate of interest rates often tend to be more than finances with collateral, such as a residence or car. The average personal car loan rate of interest for customers with excellent credit history (760-plus) is around 9%, according to Borrowing, Tree information.

You've most likely become aware of house equity finances as well as house equity lines of credit rating (HELOCs) - however just how helpful are they when it pertains to financing renovations? You can utilize a residence equity car loan or HELOC for kitchen and restroom remodels, landscape design, brand-new roofing as well as house siding, and also more. Frequently property owners make use of HELOCs to Find Out More fund significant renovation projects, as the interest rates are less than they are on individual car loans as well as bank card.

In this guide, we are going to take a look at what residence equity lendings and HELOCs are, how they help funding restorations, just how much you can obtain, as well as the advantages and disadvantages to both of these alternatives. A basic HELOC might not be next the best way for you to fund your remodelling.

The Facts About Second Mortgage Vancouver Uncovered

Using Equity To Finance Residence Improvements, Using equity to finance a home remodelling job can be a smart move. You need to recognize just how it works to be able to figure out your best financing choice. The larger the distinction between the amount you owe on your home loan as well as the worth of your residence, the more equity you've got.

Yet your residence's value can go down, along with up. Residential property rates transform on a regular basis, and when the market is executing well and prices get on the rise, your equity will certainly increase. When the market is down, this can decrease the value of your residence and also minimize your equity.

As an example, if your residence Get More Information is worth $500k and your present mortgage balance is $375k, a house equity lending can allow you obtain as much as $75k. (90% multiplied by $500k, minus $375k)These are guaranteed fundings that use your home as security, meaning that you can lose this in the occasion that you are unable to pay.

The Only Guide to Home Equity Loans Bc

They're almost always fixed-rate finances with established terms, payments, and timetables. When you're authorized for a funding, you obtain the full quantity in one lump amount.

Touching all the equity in your house in one swoop can work against you if building worths in your location decrease. If property values reduce, the market value of your home could decrease, and you could wind up owing even more than your house is worth. The home could be marketed to please the continuing to be financial obligation if the financing is not paid off or goes right into default.